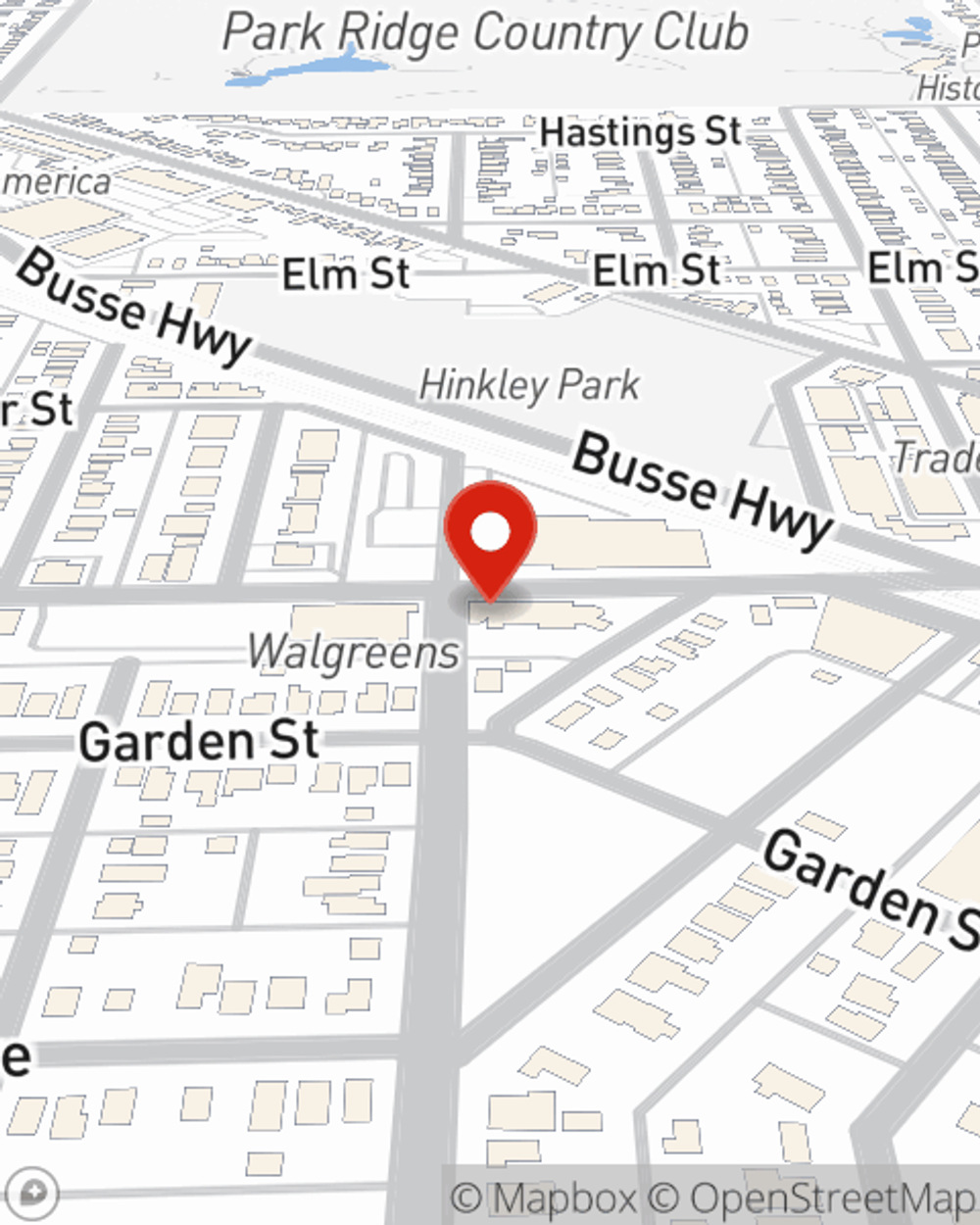

Condo Insurance in and around Park Ridge

Looking for great condo unitowners insurance in Park Ridge?

Quality coverage for your condo and belongings inside

- Park Ridge

- Chicago

- Edison Park

- Glenview

- Northwest Indiana

- Jefferson Park

- Des Plaines

- Rosemont

- Wisconsin

- Indiana

- Mount Prospect

- Arlington Heights

- Norwood Park

- Harwood Heights

- Northbrook

- Niles

- Norridge

- Elmwood Park

- Lakeview

- Avondale

- Lake Geneva

Welcome Home, Condo Owners

Looking for a policy that can help insure both your condominium and the books, electronics, furniture? State Farm offers impressive coverage options you don't want to miss.

Looking for great condo unitowners insurance in Park Ridge?

Quality coverage for your condo and belongings inside

Condo Coverage Options To Fit Your Needs

Everyone knows having condominium unitowners insurance is essential in case of a windstorm, hailstorm or fire. Adequate condo unitowners insurance can cover the cost of reconstruction, so you aren’t left with the bill for a home that isn’t habitable. An additional feature of condo unitowners insurance is its ability to protect you in certain legal situations. If someone is injured at your residence, you could be required to pay for their medical bills or the cost of their recovery. With good condo coverage, you have liability protection in the event of a covered claim.

There is no better time than the present to reach out agent Neal Salah and explore your condo unitowners insurance options. Neal Salah would love to help you choose the right level of coverage.

Have More Questions About Condo Unitowners Insurance?

Call Neal at (847) 823-0353 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.